Landlord Sentiment Shifts in 2025: Fewer Acquisitions, More Spending on Existing Properties

New surveys from RentRedi and BiggerPockets reveal a 14-point drop in landlords planning to buy amid concerns over home prices and interest rates, while investments in existing rental properties rise considerably

NEW YORK, July 22, 2025 (GLOBE NEWSWIRE) -- New survey results from RentRedi, the fastest-growing rental management software, including joint data from BiggerPockets, show a measurable shift in landlord priorities for 2025. Compared to late 2024, fewer landlords plan to expand their portfolios, while more are investing in property improvements and optimizing operations. RentRedi’s rental market survey examines notable shifts in trends relating to investment strategies, renovation spending, and business priorities over time.

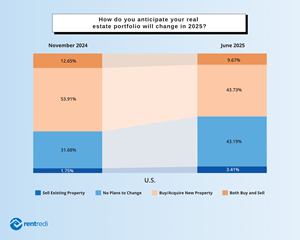

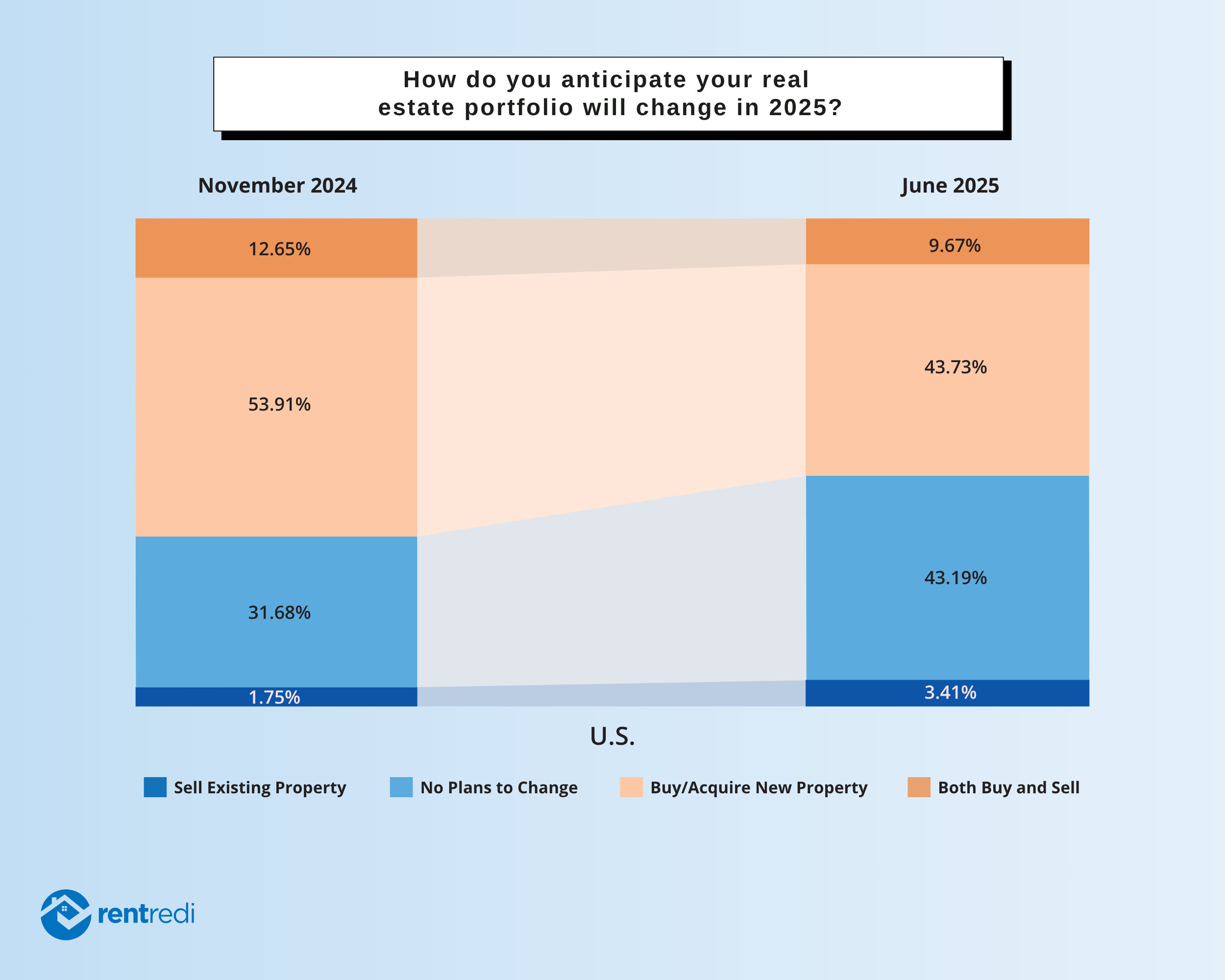

As a follow-up to a survey that was conducted in November 2024, the same questions were posed to U.S. landlords between June 3-26, 2025, and responses were analyzed by region and landlord size. Over the past six months, the share of landlords planning to buy new properties dropped from 67% in November 2024 to 53% in June 2025—a 14-point decline. During the same period, the portion of landlords with no plans to change their portfolio rose by 11% from 32% to over 43%. Fewer than 1 in 25 landlords say they plan to sell a rental property this year.

Regionally, the West experienced the biggest shift in sentiment, with the number of landlords saying they have no plans to make portfolio changes rising from 39% to 53%, a 14-point increase. In contrast, the Northeast was the most acquisition-oriented region, with 57% of investors still planning to buy property in 2025, outpacing the national average.

Differences by landlord size also emerged. While all portfolio sizes saw a decline in buying plans, landlords with 20 or more units remain more active than their smaller counterparts. A little over 1 in 5 large landlords plan to both buy and sell property this year, compared to just 5% of small landlords. Nearly half of small landlords say they have no plans to change their portfolio, compared to 38% of large landlords.

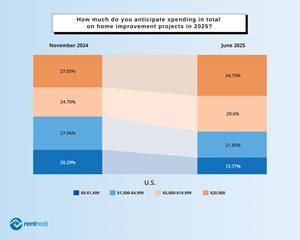

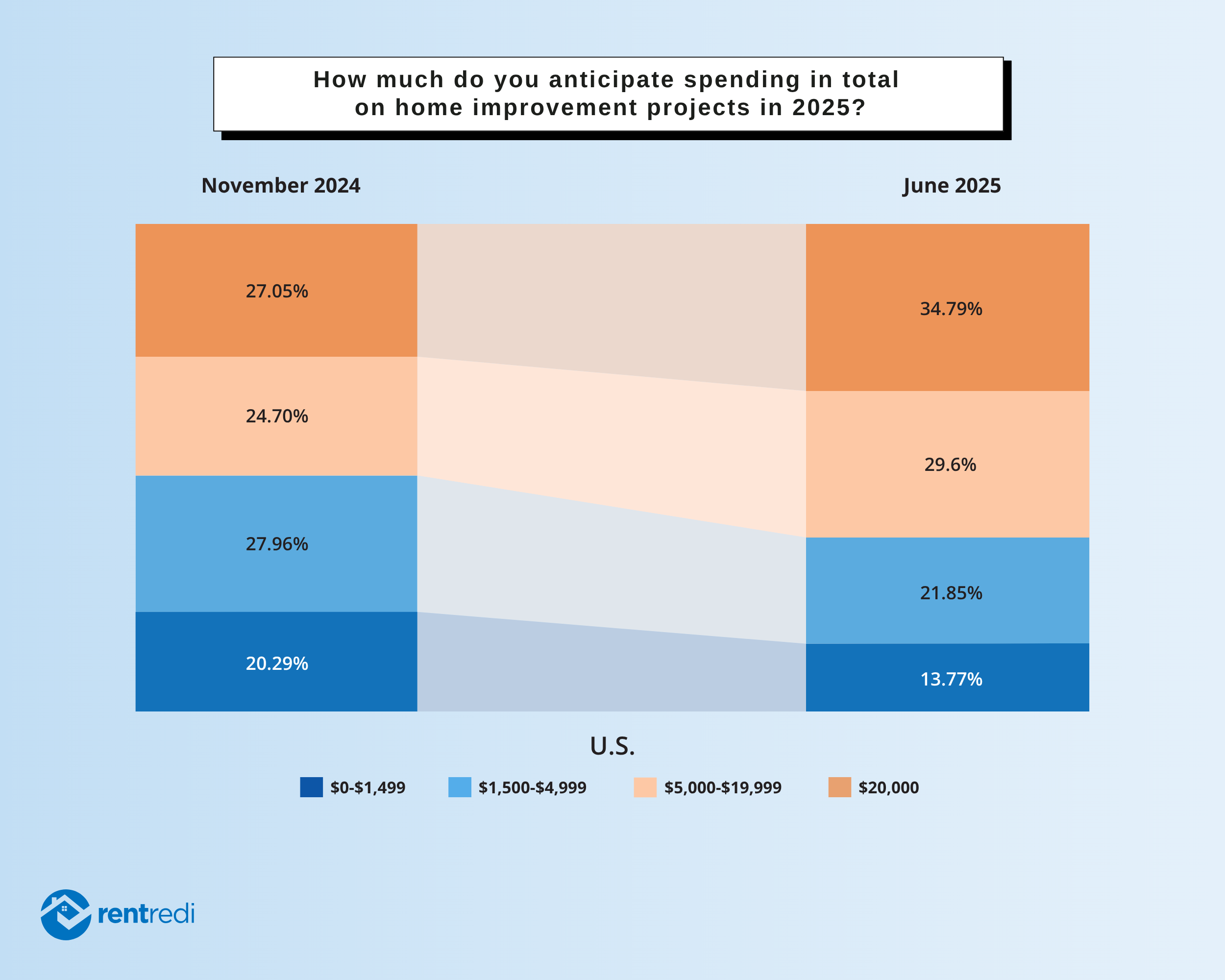

Another major shift is visible in home improvement plans. As of June, 35% of landlords expect to spend more than $20,000 on property upgrades this year, up from 27% in November. Nearly 2 in 3 respondents anticipate spending over $5,000 in total. Landlords with large portfolios are leading the charge: nearly two-thirds expect to spend more than $20,000, up from 36% in November. Small landlords remained more conservative, with nearly half still budgeting under $5,000.

Regionally, the Midwest and West saw the most dramatic increases in high-dollar spending. In both regions, the share of landlords expecting to invest more than $20,000 rose by 10 points or more. At the same time, a June joint survey with BiggerPockets found that exactly half of landlords have paused some or all home improvement projects planned for 2025, suggesting a range of financial strategies and priorities depending on portfolio structure and resources.

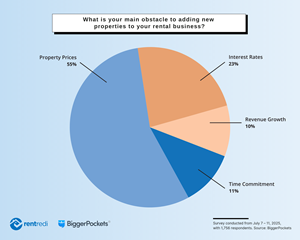

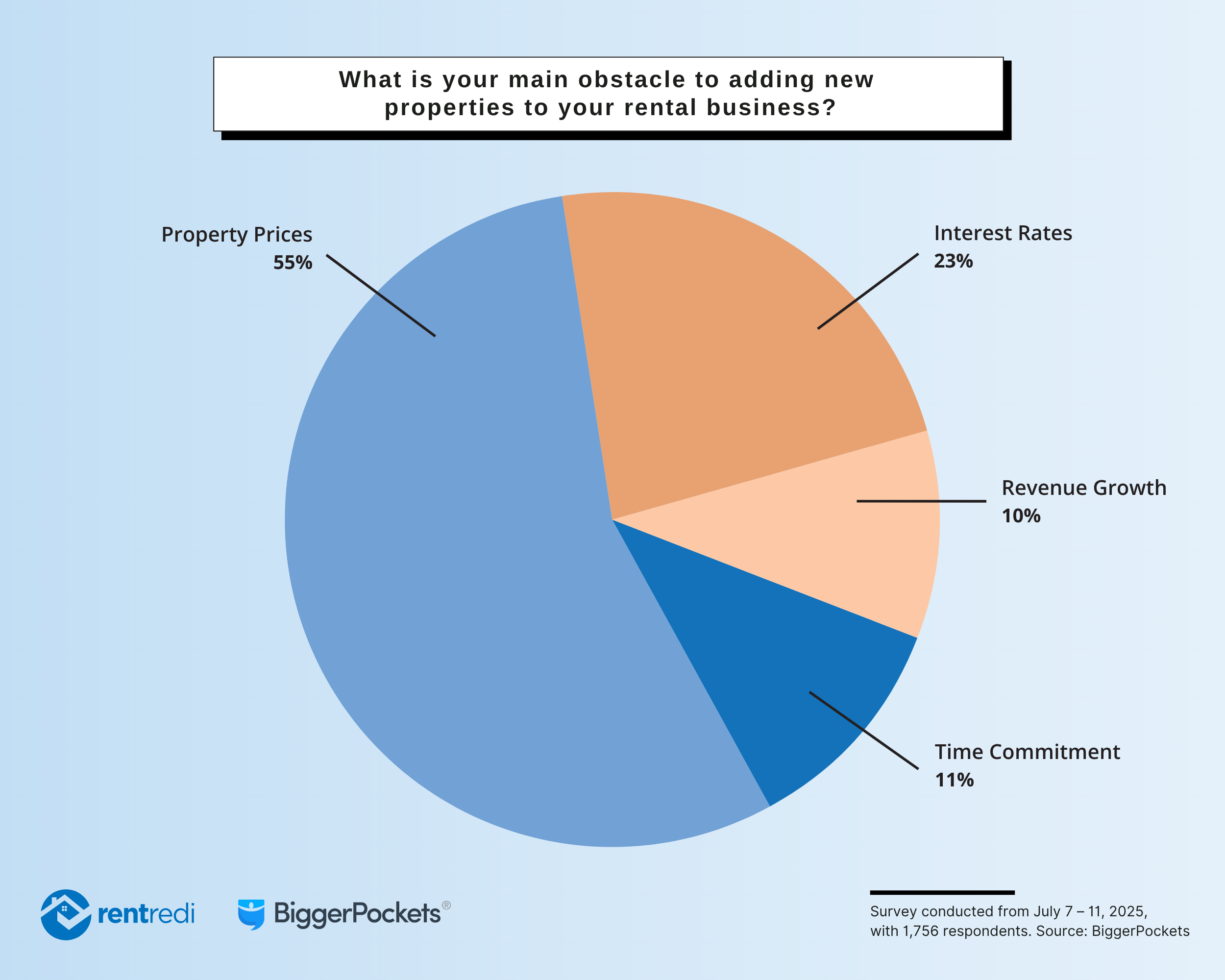

A separate July survey from RentRedi and BiggerPockets explored the reasons behind declining acquisition plans. More than half of landlords cited property prices as the biggest barrier to buying, while nearly a quarter pointed to interest rates. Others said slow revenue growth or time commitment were their main challenges.

When asked what they hoped to achieve by using tools or resources in their rental business, more than one-third said increasing revenue was most important. Another one-third prioritized saving time and effort, followed by reducing costs and increasing property value.

“With tools like RentRedi, landlords are managing their properties more efficiently, even as they face evolving challenges,” said RentRedi Co-founder and CEO Ryan Barone. “From automation to mobile access to financial reporting, we’re focused on giving landlords the control and visibility they need to make smarter decisions—whether they’re expanding, renovating, or holding steady.”

Landlord motivations remained consistent across the board. Income generation continues to be the top reason for managing rental properties, selected by over 40% of respondents, followed by long-term investment and financial freedom. Larger landlords are more focused on income—more than half selected it as their primary goal, compared to about one-third who emphasized long-term investment and 16% who cited financial freedom, which is slightly below the 18% national average.

Diversification appears to be a low priority in 2025. About 40% of landlords said they do not plan to diversify their portfolios by property type or location, and another quarter are unsure. Slightly more than 1 in 3 landlords say they plan to diversify in any way this year.

This report is part of RentRedi’s ongoing initiative to surface real-world insights from landlords and property managers through data, direct surveys, and collaborations with trusted communities like BiggerPockets. For more data insight and survey result reports, visit RentRedi’s Rental Market Insights.

Survey Methodology

RentRedi landlords were surveyed between June 3-26, 2025. There were 1,623 respondents in total. Landlords were classified into U.S. regions by their primary business location as follows: Northeast (CT, MA, ME, NH, NJ, NY, PA, RI); Midwest (IA, IL, IN, KS, MI, MN, MO, ND, NE, OH, SD, WI, VT); South (AL, AR, DC, DE, FL, GA, KY, LA, MD, MS, NC, OK, SC, TN, TX, VA, WV); and West (AK, AZ, CA, CO, HI, ID, MT, NM, NV, OR, UT, WA, WY). Landlords were also classified by real estate portfolio size as follows: small landlords (1-4 rental units); medium landlords (5-19 rental units); and large landlords (20+ rental units). Percentages have been rounded to the nearest whole number, and therefore the values in each barchart may not equal 100%. Separately, BiggerPockets conducted its own surveys via YouTube in June and July 2025. The full survey results can be found here.

About RentRedi

RentRedi offers an award-winning, comprehensive rental property management platform that simplifies the renting process for landlords and renters by automating and streamlining processes. Investors can quickly grow their rental businesses by using RentRedi's all-in-one web and mobile app for rent collection, market listings, tenant screening, lease signing, maintenance coordination, and accounting. Tenants enjoy the convenience and benefits of RentRedi’s easy-to-use mobile app that allows them to pay rent, set up auto-pay, build credit by reporting rent payments to all three major credit bureaus, prequalify and sign leases, and submit 24/7 maintenance requests.

Founded in 2016, RentRedi is VC-backed and a proven leader in the PropTech market. The company ranks No. 180 on the Inc. 5000 list and No. 13 on the Inc. 5000 Regionals list. It was also named an Inc. Power Partner in 2023 and 2024, and to Fast Company’s Next Big Things in Tech list in 2024, as well as HousingWire’s Tech100 list in 2025. To date, RentRedi has more than $28 billion in assets under management with nearly 200,000 landlords and tenants using its platform. The company partners with technology leaders such as Zillow, TransUnion, Experian, Equifax, Realtor.com, Lessen, Thumbtack, Plaid, and Stripe to create the best customer experience possible. For more information visit RentRedi.com.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1e1f54bc-0e48-44d2-ac3d-91e5bc17b910

https://www.globenewswire.com/NewsRoom/AttachmentNg/caf18e40-7b6f-4476-813a-0e363f878e93

https://www.globenewswire.com/NewsRoom/AttachmentNg/8172cf42-500a-4823-9640-3a5dbf32fa91

RentRedi Media Contact: Jennifer Tolkachev jen@rentredi.com

Joint RentRedi / BiggerPockets survey reveals landlords concerns about real estate investing

A joint survey from RentRedi and BiggerPockets explored the reasons behind declining acquisition plans in 2025. More than half of landlords cited property prices as the biggest barrier to buying, while nearly a quarter pointed to interest rates. Others said slow revenue growth or time commitment were their main challenges.

RentRedi survey: Landlords plan less acquisitions in 2025

A RentRedi rental market survey shows that the share of landlords planning to buy new properties dropped from 67% in November 2024 to 53% in June 2025—a 14-point decline. During the same period, the portion of landlords with no plans to change their portfolio rose by 11% from 32% to over 43%. Fewer than 1 in 25 landlords say they plan to sell a rental property this year.

RentRedi survey: Landlords plan more home improvement spending in 2025

A RentRedi rental market survey shows that 35% of landlords expect to spend more than $20,000 on property upgrades this year, up from 27% in November. Nearly 2 in 3 respondents anticipate spending over $5,000 in total.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.