OwlTing Introduces OwlPay® Stablecoin Checkout™ for Global Businesses

The Company Expands U.S. Presence with New Money Transmitter Licenses in Pennsylvania, Wisconsin, and Colorado, Now Operating in 36 U.S. States

ARLINGTON, Va., July 29, 2025 (GLOBE NEWSWIRE) -- OwlTing Group (the “Company”), a global blockchain fintech company, today announced the launch of OwlPay® Stablecoin Checkout™, a new API-embedded stablecoin acquiring1 function set to go live in August 2025. With newly approved Money Transmitter Licenses (MTLs) in Pennsylvania, Wisconsin, and Colorado, OwlTing is now available for fund operations in 36 U.S. states2, reinforcing its commitment to compliant, fast, and scalable cross-border payments.

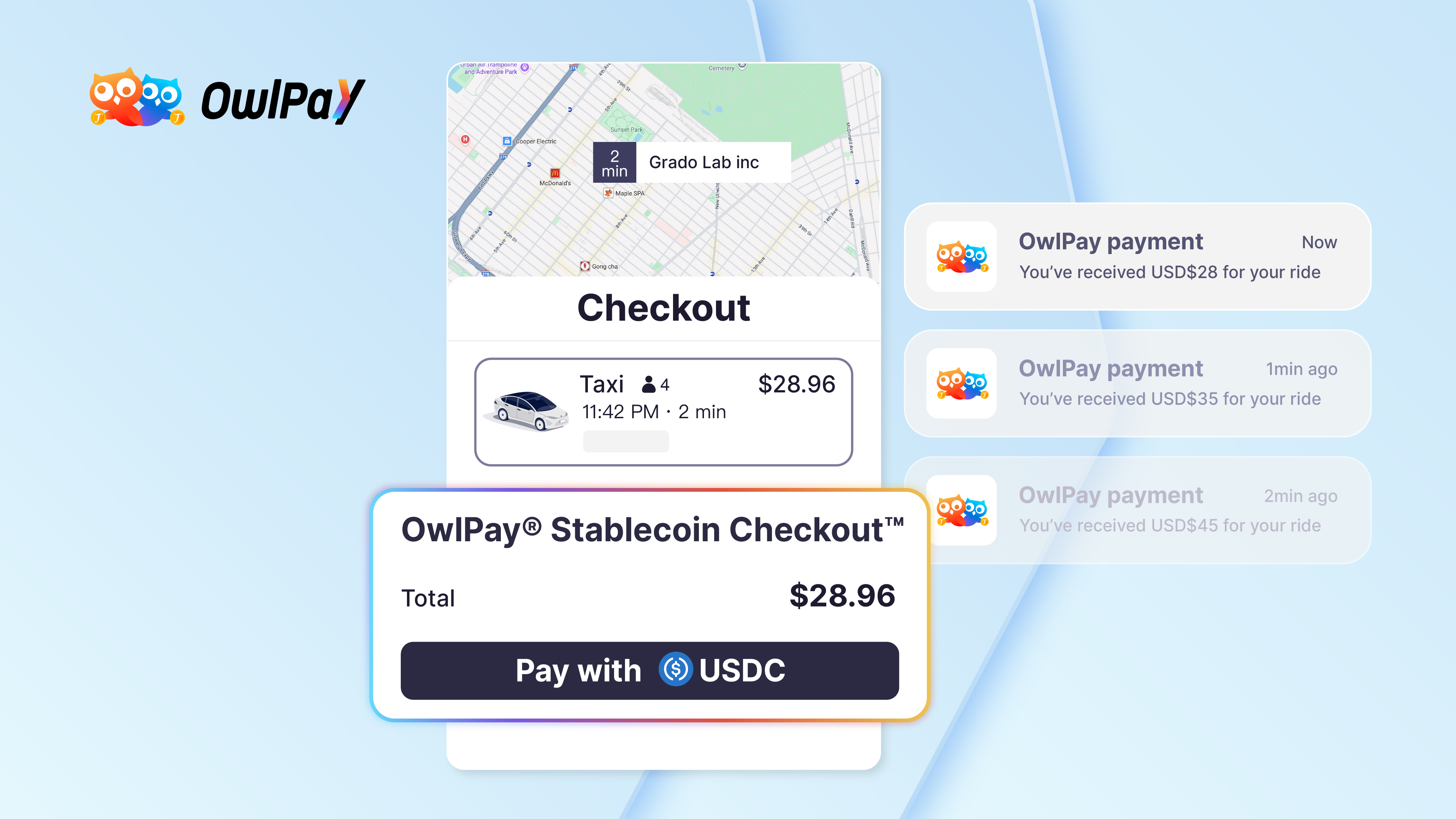

Designed for global enterprises in mobility, hospitality, e-commerce, and gaming sectors, OwlPay® Stablecoin Checkout™ enables seamless USD-USDC3 conversions, allowing businesses to accept stablecoin payments and settle in USD through their own platforms or leveraging the built-in feature on the user interface of OwlPay® Payment, the flagship B2B payment tool for businesses of all sizes.

“To bridge the gap between fiat and digital currencies, OwlPay® Stablecoin Checkout™ is a game-changer as to how businesses open up the revenues from stablecoins,” said Darren Wang, Founder and CEO at OwlTing Group. “Imagine a world where a traveler pays for a stay in USDC, a driver gets paid in USD, or a merchant settles global sales without worrying about currency fluctuations, all securely handled in the background. That’s the future we’re building, empowering businesses to thrive in a borderless economy with confidence and ease.”

OwlPay® Stablecoin Checkout™ allows large enterprises to integrate OwlPay® Harbor™, the AI-powered4 payment API infrastructure, for a customized payment experience within their own user interfaces, enabling end customers to pay in USDC while businesses receive USD in their digital wallets or bank accounts. For small and medium enterprises (SMEs) without technical expertise, OwlPay® Payment offers a ready-to-use interface with the embedded stablecoin checkout function, delivering a streamlined payment journey. This flexibility unlocks the $260 billion stablecoin market5 for businesses seeking efficient, low-cost payment solutions.

How OwlPay® Stablecoin Checkout™ works for global commerce with or without a payment API, for example:

-

Mobility Platforms

A ride-hailing app integrates OwlPay® Stablecoin Checkout™ to allow passengers (payers) to pay for rides in USDC via the app’s interface. OwlPay® converts these USDC payments to USD, depositing the funds into the app’s or driver’s (receiver’s) designated digital wallets or bank accounts. This ensures fast, compliant payouts across over 100 countries6, reducing foreign exchange costs and settlement delays. -

Hospitality Platforms

An online travel agency integrates OwlPay® Stablecoin Checkout™ via APIs into its booking platform, enabling travelers (payers) to pay for hotels, flights, or tours in USDC. OwlPay® converts these USDC payments to fiat, disbursing funds to hoteliers, tour operators, or airlines (receivers) in their local currencies7 (e.g., CAD, EUR, GBP, JPY). -

E-Commerce Platforms

An online retailer uses the OwlPay® Payment’s interface with the OwlPay® Stablecoin Checkout™ feature to allow customers (payers) to pay for products in USDC. OwlPay® instantly converts USDC payments to USD, depositing funds to the retailer’s (receiver’s) digital wallets or bank accounts. This simplifies cross-border sales and unlocks the retailer’s business without the need to manage complex blockchain integrations. -

Gaming Platforms

A gaming marketplace adapts to the OwlPay® Payment’s interface with the OwlPay® Stablecoin Checkout™ feature, providing a way for gamers (payers) to purchase games, in-game items, or subscriptions in USDC. OwlPay® converts these USDC payments to USD, transferring funds into the platform’s or gaming developer’s (receiver’s) digital wallets or bank accounts. Faster settlements allow developers to reinvest in new games and enhance community engagement, fostering loyalty and positive player experiences.

The rise of stablecoin payments, with $5.7 trillion in total transaction volume across 1.3 billion payment transactions in 20248, underscores the demand for efficient digital payment solutions. To address this trend and ensure trust and reliability for global operations, OwlTing continues to grow its regulatory footprint, with MTLs or equivalents now secured in 35 U.S. states. The Company is actively pursuing licenses in additional U.S. states and global markets like Japan and the EU. With adherence to strict KYC/AML standards and plans for adapting to the NIST Cybersecurity Framework (CSF)9 later this year, OwlTing remains a trusted partner for businesses navigating the future of stablecoin in global payments.

About OwlTing Group

Founded in 2010, OwlTing is a global blockchain fintech company headquartered in Taiwan and has subsidiaries in the U.S., Japan, Poland, Singapore, Hong Kong, Thailand, and Malaysia. In 2025, OwlTing was named a top stablecoin innovator by CB Insights, ranked #2 globally under the B2B & Enterprise Solution. In 2022, it was selected by KPMG and HSBC as “the Leading 3 Emerging Giants in Taiwan”. With the mission to usher in the digital transformation of traditional payment processes, while ensuring legal compliance, OwlTing introduced OwlPay®, a Web2 and Web3 hybrid payment solution, to empower global businesses to operate confidently in the expanding stablecoin economy. For more information, visit https://www.owlting.com/portal/?lang=en.

Media Contact

pr_office@owlting.com

1 Stablecoin acquiring enables businesses to accept payments in USD-pegged digital currencies such as USDC, which OwlPay® converts the payments to USD for global transactions.

2 Availability may vary by jurisdiction and is subject to change. As of July 2025, OwlTing Group has obtained MTL licenses or their equivalent in 35 U.S. states and is applying for licenses in additional states. For a list of U.S. licenses obtained, please see https://www.owlting.com/owlpay/licenses?lang=en.

3 USDC is an internet-native, fully-reserved, regulated digital dollar that leverages blockchain networks to enable businesses, developers, and individuals to conduct near-real-time, low-cost global transactions. It is a leading, fully-reserved global stablecoin issued through Circle’s regulated affiliates. To learn more about using or accessing USDC, visit USDC.com.

4 OwlPay® Harbor™ uses Model Context Protocol (MCP), a tool similar to a “USB-C port for AI models”, to simplify API integration for businesses while helping developers easily connect their AI models without sharing sensitive data.

5 According to DeFiLlalma, the data aggregator for DeFi, the total stablecoin market cap is over $260 billions as of July 2025.

6 Availability may vary by jurisdiction and is subject to change. Please refer to the most current service documentation or contact OwlPay® support for the latest coverage.

7 OwlPay® Harbor™ processes transactions as local payments in the following 10 currencies: EUR (via SEPA), CAD, GBP, JPY, SGD, HKD, ZAR, AED, MXN, and BRL. Availability is subject to change. Please refer to the most current service documentation or contact OwlPay® support for the latest coverage.

8 According to the Visa Onchain Analytics Dashboard, please check https://visaonchainanalytics.com/.

9 NIST Cybersecurity Framework (CSF) was developed by the U.S. National Institute of Standards and Technology. It provides guidance to industry, government agencies, and other organizations such as OwlTing to manage cybersecurity risks.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/1d69f77a-488c-4a22-8c0a-67cbd8fd9eab

OwlPay® Stablecoin Checkout™ allows customers to pay businesses in USDC, with payments converted to USD and deposited into the business’s digital wallets or bank accounts.

OwlPay® Stablecoin Checkout™ allows customers to pay businesses in USDC, with payments converted to USD and deposited into the business’s digital wallets or bank accounts.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.